He explains how capitalism, and only capitalism, can and does make us prosperous.

Alas, he also shows how rare this perspective is by being so rare himself.

How did he become the leader of Argentina?

Or lead any political party?

Amazing.

He explains how capitalism, and only capitalism, can and does make us prosperous.

Alas, he also shows how rare this perspective is by being so rare himself.

How did he become the leader of Argentina?

Or lead any political party?

Amazing.

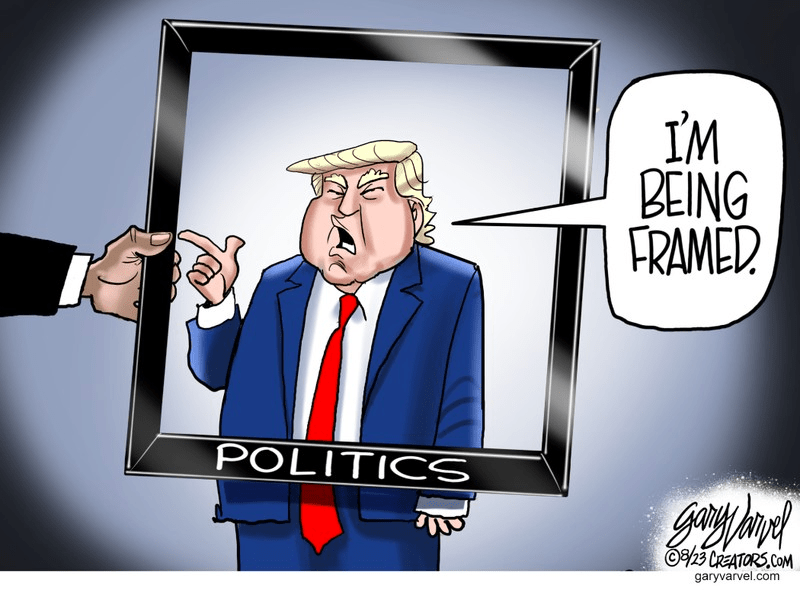

This seems to capture the politics of our time all too well.

Donald Trump is to me and about half the American population, about a good a leader as can be found. The other half likes Joe Biden, for whom there is no one to be referred.

Clearly, the two halves do not understand each other, so we will just have to see how it ends up.

This covid business has retreated into the shadows although it remains the largest presence of our time (though largely undiscussed).

I try to conjure how the future will see us but nothing really comes to mind. My guess is we will be be irrelevant since nothing we concern ourselves with today will concern anyone in the future. Our concerns will be n one’s future concerns so if they think of us at all it will be to think if us of no interest to themselves.

We have, it seems, nothing to teach the future.

There is only one way a community can become prosperous and that is if the government backs away and lets those who wish try to become personally well off by producing goods and services for their fellow citizens.

Nothing else works. The government and the rest of the community must let the productive get on with their putting together their productive efforts and the government must stand back and let them get on with it.

This is what went on in the West from around 1750 till around 2000. There was plenty of grumbling and the rise of socialism to try to stop it but it did succeed. The process has now been brought to an end although some of the previous momentum does remain.

But it’s the only way it can occur, While the rest of the population resents the accumulation of personal wealth by these entrepreneurs, neither the elites, nor the government tries to stop entrepreneurial inventiveness but just lets it happen.

While it might continue at the present, there are now too many who wish to bring it all to an end. and have worked out how it can be halted. The vast majority will not let others become rich through entrepreneurial effort. I may be wrong but if it has been halted, it won’t come back for a thousand years and perhaps more.

Governments will not leave things alone nor will the population let them.

It is surprising that it is only very occasionally that someone will step up and be counted in a political fight. Here Riley Gaines went out and attacked the very idea of a male competing in women’s sports, in this case swimming.

This is taken from https://www.powerlineblog.com/archives/2023/07/riley-gains-admirers.php where you will also find this comment:

I admire Riley. It’s hard. As a woman, a high achiever, an athlete and one who still competes today, and a mother, this topic hits me in several areas. When you go to places and try speaking up, it’s amazing just how quickly and viciously you get shut down and shut out for speaking up. Now, I’m a strong person, and I’m not crushed, but I don’t have a platform to speak from anymore either except in places like these where people are going to almost exclusively agree with me