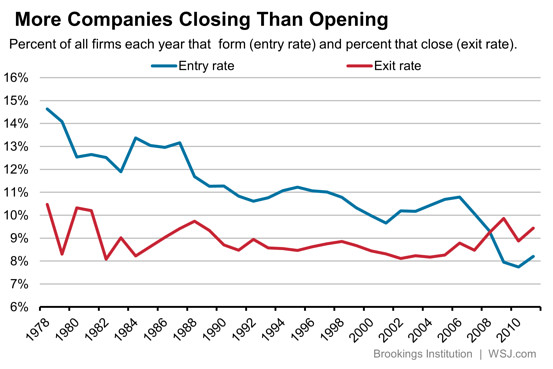

The descent of the United States is taking so many different forms but economically it is heading down towards the middle of the pack and will fall lower before it even begins to turn around. This story from the Wall Street Journal looks at one aspect of this demise: Why It’s Worrying That U.S. Companies Are Getting Older. The effect of public spending and low rates of interest are not just inflation but also come in the form of a crumbling capital stock. In fact, this decay of capital is more insidious since it is harder to identify but eventually there is no doubting that the process is in place and that it is having a devastating effect.

Meanwhile there is this fully related story although modern economic theory would have trouble seeing how the are connected: $7,060,259,674,497.51–Federal Debt Up $7 Trillion Under Obama. How do you suppose this will eventually work its way out?

As of June, there were 115,097,000 households in the United States, according to the U.S. Census Bureau. The $17,687,136,723,410.59 in debt the federal government had accumulated as of the end of July equaled $153,671.57 per household.

The $7,060,259,674,497.51 in new debt that the federal government has taken on during Obama’s presidency equals $61,341.82 per household.

An absolute shambles and with no one in charge.