J.E. Cairnes back in 1888 stated that there was nothing that an economist could learn by using maths that they could not think through in words. I thought of this looking at a recent post from The Grumpy Economist on Open-Mouth Operations, that is, a discussion of the way comments by the Chairman of the Fed of themselves shift markets. This is the lead-in para to the model:

Our central banks have done nothing but talk for several years now. Interest rates are stuck at zero, and even QE has stopped in its tracks. Yet, people still ascribe big powers to these statements. Ms. Yellen sneezes, someone thinks they hear “December” and markets move.

And these are the maths behind his words.

Use the standard “new-Keynesian” model

xt=Etxt+1−σ(it−Etπt+1)

πt=βEtπt+1+κxtAdd a Taylor rule, and suppose the Fed follows an inflation-target shock with no interest rate change

it=i∗t+ϕπ(πt−π∗t).

i∗t=0

π∗t=δ0λ−t1Equivalently express the Taylor rule with a “Wicksellian” shock,

it=î t+ϕππt

î t=−δ0ϕπλ−t1.In both cases,

λ1=(1+β+κσ)+(1+β+κσ)2−4β‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾√2>1

Yes, this is a special case. The persistence of the shocks is just equal to one of the roots of the model. Here δ0 is just a parameter describing how big the monetary policy shock is.

Now, solve the model by any standard method for the unique locally bounded solution. The answer is

πt=δ0λ−t1,

κxt=δ0(1−βλ−11)λ−t1

it=0

This is how policy is now discussed and determined. But do note the equilibrium that comes out of it. Just don’t ask me to explain what you have just read so which is why I will let the author do it:

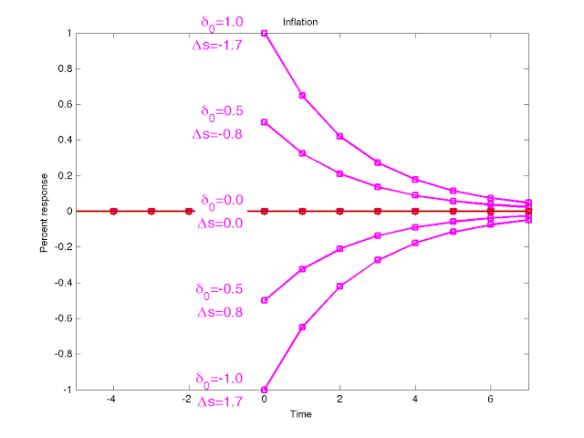

And here is the path of output. In each case δ0 in the graph gives the size of the monetary policy shock. It’s also the size of the inflation jump at time zero induced by the monetary policy shock.

Watch this mom, no hands… Interest rates do not budge throughout the episode. The Fed announces a monetary policy shock, and inflation moves just enough so that the systematic part of monetary policy offsets the shock, and Fed doesn’t end up actually doing anything! We get the traditional results of monetary policy — lower inflation and lower output, for example — based just on talk!

If you’re inclined to this sort of model, you might want to pursue this sort of solution as a model of our current “open-mouth” regime.

This is too far for me to go. It gives up on traditional “monetary” policy. “Monetary” policy is here pure “multiple equilibrium selection” policy. The Fed makes a different set of off-equilibrium threats and we jump to a different one of multiple equilibria. Interest rates are completely irrelevant to the standard effects of monetary policy here.

So I view the calculation as an indication of fundamental problems with the model I wrote down above, a reductio ad absurdum. But others may want to take it seriously. Hence the “thesis topics” tag.

Granted, the standard view of open mouth operations is that Fed statements change expectations of future interest rate paths — actual, observed, equilibrium interest rate paths, not these shocks which are offset by inflation. But sooner or later rational expectations have to kick in — you can’t endlessly promise interest rate changes that never happen. So the open mouth operation is an interesting limit, in which statements about interest rates matter, but the Fed never has to actually do anything about interest rates.

Also granted, I don’t have a better model of why markets move so much on Fed chatter.

The Δs numbers index how much fiscal policy must cooperate in each case. If there is a jump down in inflation, that means greater value of government debt, and fiscal policy must raise surpluses by the indicated percentage. For the fiscal theory of the price level, these paths are then paths that happen when there is a pure change of fiscal expectations, and the Fed does nothing about monetary policy. I find that a much nicer interpretation.

Reserve Bank of New Zealand Governor Donald Brash coined the word “open mouth operations,” observing that he seemed to be able to move interest rates by simply talking, without conducting open market operations. This is a second level of open mouth — here the Fed can move inflation itself just by talking.

So do statements by the Chairman of the Fed affect the inflation rate, and if so how, and if not, why not? But more to the point here, whatever you personally believe, do you need the maths and the model to explain your conclusion?