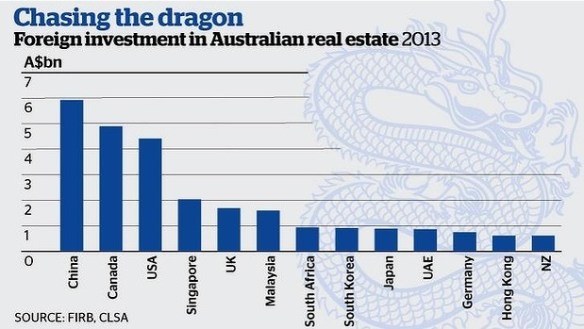

This is already an old story, from the SMH on October 11. It’s heading is quite straightforward, Chinese investors are pushing into Melbourne and Sydney. And the text of the article is also pretty clear:

Chinese investors are aggressively lifting their Australian residential and commercial real estate investment.

And then there was this on October 15, Foreign buyers snap up one in six new Aussie homes:

Foreign buyers are flocking to buy Australian property, snapping up one out of every six new homes – and that number is set to get higher.

Foreign demand for new homes surged in the September quarter and is tipped to rise further next year, according to the National Australia Bank’s latest residential property survey.

Overseas buyers accounted for almost 17 percent of total demand for new properties and in Victoria, they accounted for almost 25 percent, or one in four new homes, the report said.

Foreign buyers were also more active in the established property market last quarter, accounting for eight percent of demand.

Again, Victoria led the way, with foreigners accounting for a record high 11.5 percent of established property demand, the report said.

If you are of the opinion that none of this is pushing house prices up and keeping people like my sons out of the market, then you need to brush up a bit on supply and demand. But what has added to my dismay at all of this you may find in this story from The Age on Monday, Corrupt Chinese in AFP sting. Here’s the bit that matters:

The manager of the AFP’s operations in Asia has confirmed Australia has agreed to assist China in the extradition of and seizure of assets of corrupt officials who have fled to Australia with illicit funds running into the hundreds of millions of dollars. . . .

“As time goes on, they start to put [their funds] into legitimate assets such as houses and property”. . . .

The sums of money believed to have been spirited out from China are staggering. The Washing-based Global Financial Integrity Group, which analyses illicit finalcial flows, estimates that $US3 trillion left China illegally between 2005 and 2011.

Some of that money is coming here and it doesn’t take much of a slice of all of that to make an impact on our housing market. It is ridiculous that we haven’t done something ourselves before now, but with the Chinese now seeking to get their money back there may at least be a start.