From Drudge, just a few side comments on the American economy, not featured but just listed. All so very ho hum because really, who doesn’t know any of this:

Fed Official Warns ‘Disappointing’ Growth Could Foretell Future…

Sluggish jobs market points to structural problems…

Yellen Determined To Avoid ‘Nightmare Scenario’…

Record income gap fuels housing weakness…

Wages Down 23% Since 2008…

Bank Profits Near Record Levels…

Let’s start with the first of these, Fed Official Warns ‘Disappointing’ Growth Could Foretell Future:

The official, Stanley Fischer, who took over as vice chairman of the Fed in June, noted that although the weak recovery might simply be fallout from the financial crisis and the recession, “it is also possible that the underperformance reflects a more structural, longer-term shift in the global economy.”

In a speech delivered on Monday in Stockholm at a conference organized by the Swedish Ministry of Finance, Mr. Fischer also conceded that economists and policy makers had been repeatedly disappointed as the expected level of growth failed to materialize.

“Year after year, we have had to explain from midyear on why the global growth rate has been lower than predicted as little as two quarters back,” he said. “This slowing is broad-based, with performance in emerging Asia, importantly China, stepping down sharply from the postcrisis surge, to rates significantly below the average pace in the decade before the crisis.”

Mr. Fischer said it was difficult to determine how much of the slackness was because of cyclical factors and how much represented a more fundamental, structural change in advanced economies.

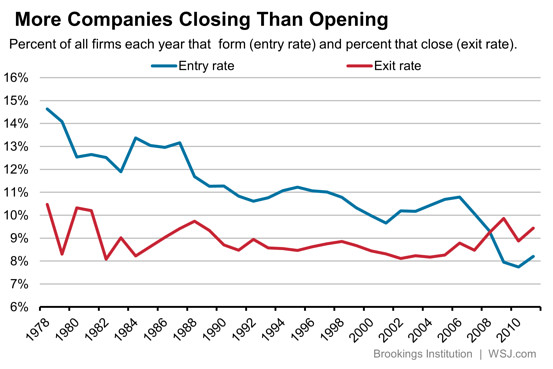

In essence, they don’t have a clue what’s going on. Clear as crystal what the problem is if you don’t think along Keynesian lines and do not believe raising aggregate demand is the answer. In fact, all of it makes perfect sense if you go back to the pre-Keynesian (i.e. classical) theory of the cycle. But economists are now three generations into Y=C+I+G that thinking in any other way is a near impossibility.

But this is the one I find the most graphic, US Wages Down 23% since 2008. The American economy is falling into bits and real incomes are falling through the floor:

U.S. jobs pay an average 23% less today than they did before the 2008 recession, according to a new report released on Monday by the United States Conference of Mayors.

In total, the report found $93 billion in lost wages.

Jobs lost during the recession paid an average $61,637. As of 2014, jobs in the same sectors paid an average of $47,171 annually.

“Under a similar analysis conducted by the Conference of Mayors during the 2001-2002 recession, the wage gap was only 12% compared to the current 23%–meaning the wage gap has nearly doubled from one recession to the next,” stated the Conference of Mayors in a statement.

The report also found that 73% of metro area households earn salaries of less than $35,000 a year.

And the only thing they have thought to do to assist business has been to lower interest rates to near zero which, if they understood anything at all, they would understand would only make matters worse.