I keep pointing out that the last person you should listen to about economic policy is anyone who has had a modern education in economic theory. Here is a bit of proof, from today’s Oz: Dismay at RBA as wages growth goes backwards. Here is the opening line of the article:

The person most disappointed with Wednesday’s sluggish wages growth figure is surely the Reserve Bank Governor. Real wages are now going backwards at 2.7 per cent.

How would it even have been possible for real wages to rise while the country has been in lockdown, our future sources of energy are under threat, government spending has risen at every turn, and while real interest rates are in negative territory?

Real wages can only grow if the flow of goods and services that wage earners can buy is rising. This can, of course, only happen if the private sector is expanding.

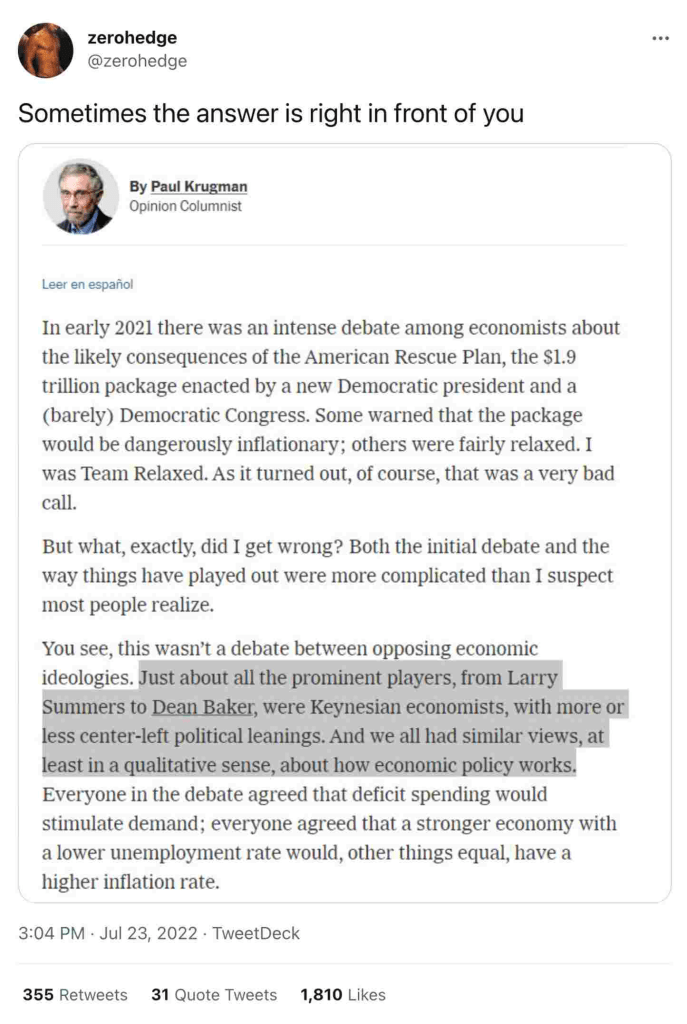

It is the proliferation of all these Keynesians who believe that increases in public sector spending on useless junk will somehow “stimulate demand” and therefore lead to a higher level of productive enterprise.

That is, these people believe that if governments waste our available resources and capital on unproductive projects of their choosing that when their overpaid virtually entirely unproductive public servants spend the wages they receive that this will propel the economy forward.

It does sicken me to watch all this in action since I can see how not only almost everyone else but also I too will have to experience a fall in my real level of income because of all this.

That central banks around the world seem to believe that negative real rates of interest are a stimulus to growth is just how it is. If you would like to be cured of this absurdity, the only place I can think to send you is to Chapter 17 of the third edition of my Free Market Economics: An Introduction for the General Reader which is titled, “Saving and the Financial System”. There are other books as well, but virtually all of them were written at least a century ago.

It is maddening to watch our economy trashed by such ignorance, but there you have it.

FROM THE COMMENTS on the same post at New Catallaxy: I try not to do this, and hardly do it at all, but this was the sole comment which to me really demands a response since I think it is so instructive. From Hubris:

I read these tirades. Do you essentially advocate a return to industrial protection and supply? It seems like you just don’t like markets.

I know I am beating my head against a brick wall, but massive levels of public spending, enormous unfunded fiscal deficits and adjustment of market rates of interest by central banks are not in any sense leaving things to the market. Why is that not utterly obvious?