They love spending the money but with the disastrous results now being recorded everywhere, it is turning out that this deficit finance has not been such a great thing after all. We are looking in the eye of the great Keynesian fail and the world will turn to deal with those C+I+G-based theories as soon as we have dispensed with the politicians who have ruined the economies they have managed based on this Keynesian nonsense.

My Free Market Economics was written in 2009 well before these disasters. It was, in fact, written precisely because these were the disasters I fully expected. I am told occasionally that there is some other way to make sense of why this increase in public spending has led to a worsening in employment growth to accompany the debt other than through a return to pre-Keynesian classical theory and Say’s Law but if there is I haven’t come across it. Austerity is the new black which merely says governments must live within their means.

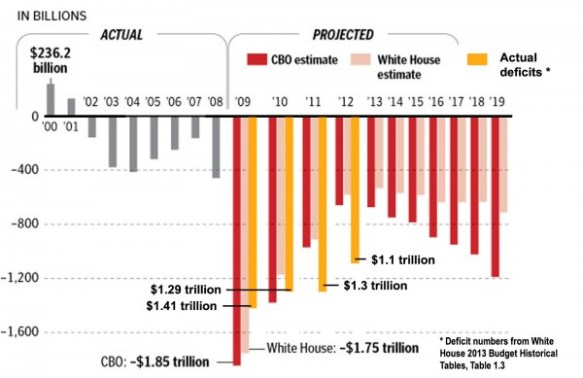

The above chart is doing the rounds – picked up on Instapundit in this instance – and shows that the deficit blow out most assuredly began with Obama who now prefers not to take the credit. The story in Australia would be even worse since the budgets all leading up to Labor taking over in 2007 were in surplus to go with our ZERO debt.

Swan and Gillard promise a surplus they will never deliver but wish they could. They now talk about the need for budget balance in the same way as any of the pre-Keynesians. And the fact is there will be no return to economic health until the public sector is reduced and the private sector is given the space to grow and expand.