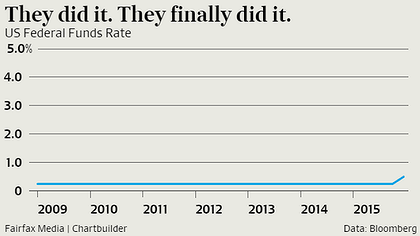

If you want to know why the American economy is going nowhere, that is a very good place to start. Here is some of the text that goes with the picture: US Federal Reserve lifts rates and that is a good thing. The following is the kind of epicycle analysis that Ptolemy might have given his blessings to:

A quantitative easing programme that accompanied the Fed’s global crisis interest rate cuts meant the US central bank added about $US4 trillion to its balance sheet as it bought bonds, injecting cash into the financial system in the process.

It intends to charge banks and other money market institutions a quarter of a per cent more for short-term funding, and pay them a quarter of a per cent more for surplus cash they deposit overnight with the Fed by way of “reverse repurchase agreements” that commit the central bank to sell bonds for cash, and then re-buy them.

The immediate danger is that demand for the higher deposit rate will be so strong that it pushes down on short-term rates again. The Fed’s solution is to massively increase the maximum size of its reverse repurchase kitty, from $US300 billion to an eye-popping $US2 trillion.

Well that’s clear enough. The US economy stays as dead as it’s been for the past seven years.